Iron condors are a popular options trading strategy that can generate income consistently. The long and short iron condor strategies are two variations of this strategy that can be used depending on your risk tolerance and the market conditions. In this article, we’ll look at the differences between these two strategies and how you can use them to your advantage in the markets.

What is an Iron Condor strategy in options trading?

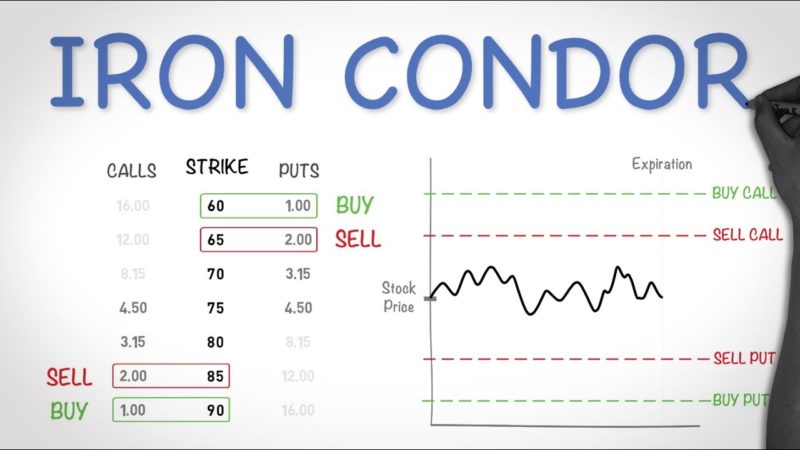

An iron condor is an options trading strategy that entails simultaneously buying and selling two out-of-the-money (OTM) call options and two OTM put options, each with the same expiration date. The idea behind this strategy is to create a small range between the strike prices of the four options you bought, which will result in a return if the underlying security remains within or near your established price range.

The long iron condor strategy involves buying a bull call spread, and a bear put spread at different strike prices. It is considered a “long” position because you are taking on limited risk due to owning both puts and calls instead of just one type of option. If the stock stays within your predetermined range, you will be in the money, whereas if it moves outside of this range, you could experience a loss.

The short iron condor strategy is the reverse of the long iron condor strategy and involves selling both a bull call spread, and a bear put spread at different strike prices. Because you are selling options instead of buying them, this is considered a “short” position. In this case, if the stock stays within your predetermined range, then you will be able to take advantage of when the option prices decrease over time due to Theta decay (time decay).

However, if the stock moves outside of your range, then you could experience significant losses due to an increase in option premiums or delta.

Benefits of the Iron Condor strategy

The iron condor is an excellent strategy for traders seeking to generate consistent market income. It is due to its limited risk nature, as you are only exposed to losing the premium you paid when opening the position. Additionally, it can be used in all market conditions, including bear and bull markets.

One of the main advantages of this strategy is that it has limited downside risk while still providing plenty of upside potential. Depending on how wide you choose your price ranges (the distance between your strike prices), you can significantly reduce the amount of money at risk while still achieving some success if the stock moves within those predetermined limits.

Drawbacks of the Iron Condor Strategy

Although there are many benefits to using an iron condor strategy, it does have its drawbacks. One of the main disadvantages is that you may experience a more significant drawdown if the stock moves outside your predetermined range. It is because options prices tend to increase exponentially as the underlying security moves further away from the strike price, resulting in a sudden surge in losses for those shorting them.

Additionally, since this strategy involves holding options over time, you could be exposed to Theta decay which can erode the value of your trades.

How to execute the Iron Condor trade

When executing an iron condor trade, paying attention to the expiration date and implied volatility of the options you are buying and selling is essential. This strategy involves buying and selling OTM options with the same expiration date, so be sure to choose a date that gives the stock enough time to move within your predetermined range.

Additionally, be sure to consider any implied volatility changes when setting up your spread, as this can significantly impact how successful your position will be.

How do you manage an iron condor trade when things go wrong?

If the underlying security starts to move outside your predetermined range, it is vital to take action to limit any losses. One of the most common strategies for managing an iron condor trade is “rolling”. It involves closing out your existing position and opening a new one with a different set of strike prices that better fit the current market conditions.

Another option would be to adjust the width of your spreads, meaning you can either tighten or widen them depending on which direction the stock is moving. Finally, you could also choose to close out your entire position if it looks like things are going south quickly, thus limiting further losses.

In conclusion

The iron condor strategy is an excellent way for traders to consistently do well in all types of market conditions. However, it does have its risks and drawbacks, so it’s essential to understand how this strategy works before you attempt to implement it. By paying attention to expiration dates, implied volatility and other market factors, you can significantly reduce your risk while taking advantage of potential opportunities that crop up.